Table of Contents

Freelance jobs are on the rise!

Currently, there are at least 57 million Americans freelancing full time. Being able to be your own boss, and work a flexible schedule, makes freelancing one of the most attractive jobs around. However, being your boss comes with a whole new set of responsibilities, like payroll and taxes.

If you’re wondering how to create your own pay stub to verify your income, then you’re in the right place! In this article, we’ll show you how easy it is to make a pay stub that’s 100% legal.

Read on to learn the best way to make a pay stub.

Information to Include

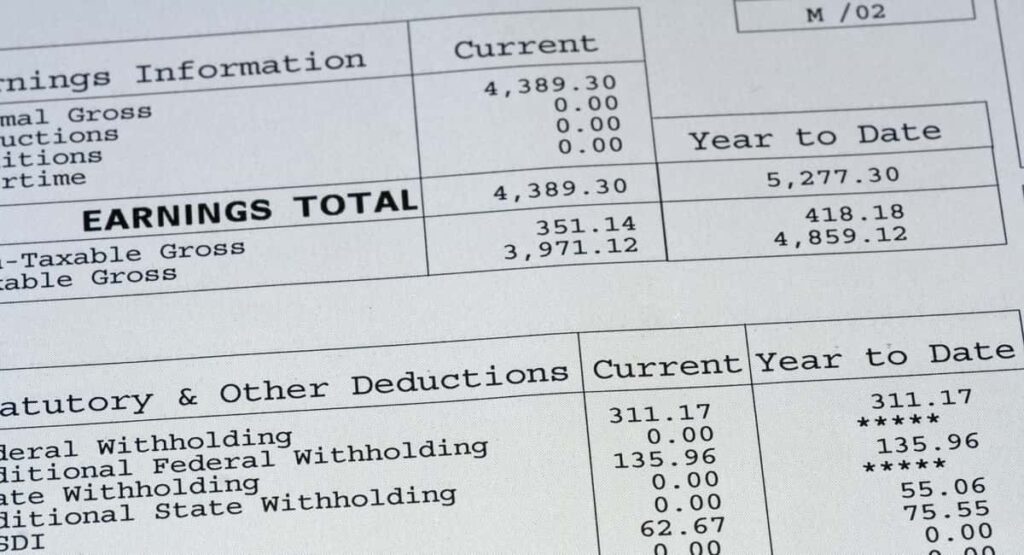

The first step in learning how to create your own pay stub is figuring out what information you need to include. Here’s a shortlist on what information what your pay stub should provide:

- Your full name

- Address

- Dates of the pay period

- Gross wages

- Taxes

- Deductions

- Contributions

- Net Pay

To make things easier, you can use a pay stub creator or template like the ones available on this site https://www.thepaystubs.com/1099-form-create. You’ll simply enter your information, decide how you want the stub to look, and then either download or print it out. As long as the information you’re using to create your paystub is accurate, the stub is 100% legal.

Gross vs. Net Pay

Moving on, let’s look at the differences between gross and net pay. When you’re listing the gross pay on your pay stub, it’ll include the total amount of money you earned before any deductions.

Whereas your net pay paints a picture of how much money you’re receiving once taxes and other contributions are taken out.

For instance, in addition to taxes, you may have money taken out for a retirement plan contribution. The funds you’re paying towards retirement don’t count for your net pay since they’re not part of your take-home pay.

Finally, remember that your gross income will always be more than your net income.

How to Create Your Own Pay Stub Records

If you’re a freelancer, learning how to create your pay stub is just the first part of your bookkeeping needs. It’s also important that you keep detailed, up to date records of your pay throughout the entire year. The more detailed your records are, the easier it’ll be to file your taxes when the time comes.

We find it’s best to store your records digitally. However, make sure that you’re computer’s protected against would-be hackers.

Tax Deduction Opportunities

Finally, as a freelancer or independent contractor, make sure you’re also keeping track of all your business expenses. For instance, keep track of things like your internet bill, your gas mileage, and your healthcare costs. You don’t want to miss out on any lucrative tax deduction opportunities!

Account for Everything

Congratulations! Now you know how to create your own pay stub. Hopefully, after reading this article you see that making a paystub doesn’t have to be a daunting, time-consuming process.

Once you make your 1st paystub, the second one will be even easier to tackle. So go ahead and start keeping records of your income today. For more tips like the ones in this article, check out the rest of this site.